Hypno$i$ By SB Kayser

From the rants and observations series

People like to show their knowledge in every occasion. It doesn’t take long to notice that opinions abound, but also differ. The strongest minds, seeking approval of the group or several persons by trying to take over the conversation, is a rule as old as humanity. The second old rule is that attention span plummets when common interests among participants are lacking, or when topics go against political correctness, or simply do not belonging to what is called conventional wisdom.

Conventional wisdom generally refers to theories endorsed by societies as irrefutable truths or axioms. That which comes immediately to mind is the necessity to view one’s borrowing ability as ace in the hole to prosper. These days "conventional wisdom" has stretched this reality so far that if one doesn’t have any credit history, one is not deemed trustworthy enough to be considered as a "potential client." Yes, let me repeat it one more time: having no credit history can be as much of a problem as having a bad credit history.

Nowadays, the only recognized criterion used by lending institutions is the clients’ commitment to avoid late and overdraft fees. This is the ultimate trick they have come up with to turn masses into debt junkies. Another form of conventional wisdom is the incentive to sell adolescent’s credit cards, hoping they will learn to manage their assets later in life… While institutionalizing the "I want it now and live richly" culture.

Because booms and manias have dotted human history, we can conclude sadly that conventional wisdom operates just like hypnosis -- and not only in the realm of economics.. Honestly, I do not criticize hypnosis, but refer to this technique which can be used for the best and the worst. The Elites have achieved a great deal at furthering their conventional wisdom platforms, especially over the last 300 years.

Let’s stick to the monetary field for the time being. From the South Sea and Mississippi Bubbles to the Dutch Tulipmania and the Dotcom Debacle, conventional wisdom has trapped so many that it still has die-hard adepts because it gives the perception that a casino economy is an inescapable but profitable truth -- in times of boom. Here the conventional wisdom rather dictates acts of pure greed using the *pump and dump stock mentality*.Conventional wisdom ignores boundaries; its only task is to provide (our) brains with the chemical reactions -- kicks - they like the most to continue their self-hypnotic trances. The more evidence that surfaces against conventional wisdom, the more psychic resistance. Persuasion does not stand a chance. Persisting in attempting to break the models created by conventional wisdom is viewed as a self-defeating tactic, the equivalent of intellectual suicide.

Let’s stick to the monetary field for the time being. From the South Sea and Mississippi Bubbles to the Dutch Tulipmania and the Dotcom Debacle, conventional wisdom has trapped so many that it still has die-hard adepts because it gives the perception that a casino economy is an inescapable but profitable truth -- in times of boom. Here the conventional wisdom rather dictates acts of pure greed using the *pump and dump stock mentality*.Conventional wisdom ignores boundaries; its only task is to provide (our) brains with the chemical reactions -- kicks - they like the most to continue their self-hypnotic trances. The more evidence that surfaces against conventional wisdom, the more psychic resistance. Persuasion does not stand a chance. Persisting in attempting to break the models created by conventional wisdom is viewed as a self-defeating tactic, the equivalent of intellectual suicide.

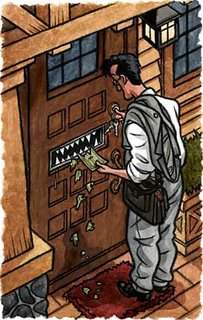

Don't believe me? Just try it and I guarantee that you will end up banging your had against the wall quite quickly.

Let's consider the three American major credit report agencies: Equifax, Experian and Trans Union for consumers as reported by the Fed. Reserve and then let's have a look at the overall social debt load that amounts to a total of $40 trillion or $136,479 per man, woman and child. 66% ($27 trillion) of this debt was created since 1990 the expert Michael Hodges reveals...

Let's consider the three American major credit report agencies: Equifax, Experian and Trans Union for consumers as reported by the Fed. Reserve and then let's have a look at the overall social debt load that amounts to a total of $40 trillion or $136,479 per man, woman and child. 66% ($27 trillion) of this debt was created since 1990 the expert Michael Hodges reveals...

How did we get there, how can the most respectable institutions run away from their responsibilities, fail their duty to protect the citizens from what appears to be "predatory lending"?

43% Of First-Time Home Buyers Put No Money Down a headline in the USAToday says... here is a relevant quote: "If we do get a spike in mortgage rates, and a modest decline (in the housing market) turns into a rout, there's almost no bottom to that," Baker says. "That's a crash scenario.

43% Of First-Time Home Buyers Put No Money Down a headline in the USAToday says... here is a relevant quote: "If we do get a spike in mortgage rates, and a modest decline (in the housing market) turns into a rout, there's almost no bottom to that," Baker says. "That's a crash scenario."Um-um, why the heck didn't the so-called agencies never warn the public, run huge TV commercials to prevent this awful outcome? Alas, there aren’t many ways to defeat this because the obvious seems to point to fraudulent policies, which are allowed to take place because of conventional wisdom: after all, we’re all taught that there is nothing really wrong with debts… As long as we can afford the (minimum) monthly payments.

Debtomenia is about to engulf America: economists argue that America's net liabilities, which totaled $2.48 trillion at the last official count, will soon cost more in interest payments than America earns in investment income...These potential consequences include rising U.S. interest rates, a sharp decline in consumer spending or a fall in the dollar. Or possibly all three... (Jan 30,2006 -Reuters)

Indoctrination often uses violence and therefore has never been sustainable, but when supported by conventional wisdom, its pernicious side effects are long and lasting. In this particular case, self-hypno$i$ will end with a trauma, resulting in the brutal collapse of many cherished delusions.

If you already went to war against conventional wisdom, you may have lost nearly all your friends because they saw your warnings as the result of reading too many senseless conspiracy theories. They will soon hate you because you incarnate the truth they refuse to see.Willing to help stop the madness? Drop us an email!

previous article: A Short Story About Billions and Trillions

3 Comments:

oakley sunglasses, ugg boots, tory burch outlet, cheap oakley sunglasses, longchamp pas cher, longchamp outlet, louboutin pas cher, tiffany and co, replica watches, michael kors pas cher, polo ralph lauren, polo ralph lauren outlet online, nike free run, longchamp outlet, jordan pas cher, oakley sunglasses, ray ban sunglasses, louis vuitton outlet, louis vuitton, louis vuitton, replica watches, burberry pas cher, tiffany jewelry, air max, nike free, ugg boots, uggs on sale, louis vuitton outlet, chanel handbags, nike outlet, ray ban sunglasses, nike roshe, longchamp outlet, oakley sunglasses wholesale, nike air max, ray ban sunglasses, prada handbags, christian louboutin outlet, christian louboutin shoes, oakley sunglasses, christian louboutin, sac longchamp pas cher, nike air max, prada outlet, christian louboutin uk, louis vuitton outlet, jordan shoes, gucci handbags, polo outlet

By oakleyses, At

6:02 PM

oakleyses, At

6:02 PM

insanity workout, timberland boots, soccer shoes, hollister clothing, wedding dresses, converse outlet, p90x workout, babyliss, longchamp uk, vans, lululemon, north face outlet, reebok outlet, nfl jerseys, hermes belt, gucci, nike huaraches, nike roshe run, iphone cases, nike air max, ralph lauren, bottega veneta, lancel, hollister, ferragamo shoes, soccer jerseys, abercrombie and fitch, baseball bats, jimmy choo outlet, louboutin, ray ban, instyler, converse, asics running shoes, celine handbags, north face outlet, mcm handbags, nike air max, hollister, oakley, chi flat iron, mont blanc pens, ghd hair, herve leger, beats by dre, nike trainers uk, valentino shoes, new balance shoes, vans outlet, mac cosmetics

By oakleyses, At

6:11 PM

oakleyses, At

6:11 PM

canada goose outlet, louis vuitton, louis vuitton, marc jacobs, canada goose jackets, moncler uk, hollister, swarovski crystal, canada goose, swarovski, moncler, louis vuitton, pandora jewelry, juicy couture outlet, moncler outlet, moncler, canada goose, wedding dresses, karen millen uk, ugg,uggs,uggs canada, thomas sabo, pandora jewelry, ugg pas cher, canada goose outlet, doudoune moncler, juicy couture outlet, toms shoes, coach outlet, pandora charms, canada goose uk, canada goose outlet, moncler, ugg,ugg australia,ugg italia, links of london, moncler, canada goose, montre pas cher, louis vuitton, louis vuitton, pandora uk, ugg uk, supra shoes, replica watches, moncler outlet, ugg

By oakleyses, At

6:15 PM

oakleyses, At

6:15 PM

Post a Comment

Subscribe to Post Comments [Atom]

<< Home